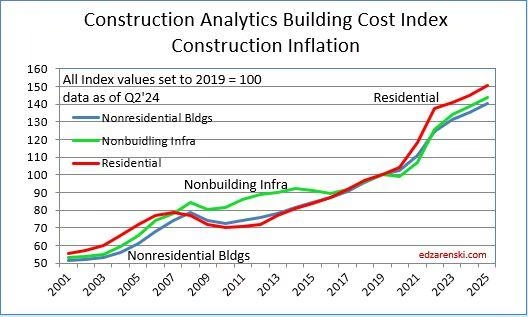

Cranes may move slowly across a skyline, but construction costs rarely stand still. Industry models suggest that, on current trajectories, the average price of delivering a building could be around 12% higher by 2030. That figure will vary by region and sector, yet the direction of travel is broadly consistent: materials remain volatile, skilled labor is tight, codes and sustainability requirements are evolving, and supply chains are being rewired. For clients, the question is less “if” costs will rise than “how” to keep them from rising on your project.

The good news is that time can be an ally. Early planning-locking in scope, sequencing procurement, testing alternative materials and methods, and aligning design with performance standards-can soften the impact of inflation and regulation before they crystallize into price. The longer decisions are deferred, the fewer levers remain.

This article outlines what is driving the projected increases, where the pressures are most likely to show up in budgets, and which actions taken in the next 6-18 months can meaningfully change the cost curve. We’ll look at scenarios rather than certainties, translating market signals into practical steps for developers, owners, and project sponsors. If the cost tide is rising, the aim is simple: choose the right moment to set foundations, not to be caught building against the current.

It’s no secret that today’s construction budgets are under siege from a complex web of forces. Pressure on labor supply is intensifying as skilled workers age out, while soaring energy prices and tightening carbon targets push operating costs ever higher. Regulatory shifts-from stricter building codes to mandatory sustainability protocols-are intensifying compliance overhead. Cost shocks will land unevenly, so clients should monitor not just broad inflation rates but also which materials and trades face the fiercest headwinds.

- Steel, concrete, and timber: exposed to volatility due to supply constraints and energy pricing.

- HVAC and electrical trades: hit by both labor shortages and complex new compliance regimes.

- Urban vs. rural regions: cost escalation trends will diverge, based on local infrastructure and workforce pipelines.

| Risk Factor | Impact | Client Action |

|---|---|---|

| Labor Scarcity | +4-5% cost uplift in skilled trades | Secure early with phased hiring |

| Energy Price Hikes | Material & transport surcharges | Favor local sourcing strategies |

| Carbon Compliance | New levies and design restrictions | Adopt standardized, low-carbon specs |

| Regulatory Shifts | Delays, redesigns, admin costs | Monitor local code changes closely |

The best insulation against these risks? Early, decisive moves-like locking down standardized designs that meet projected code requirements and pre-qualifying suppliers for efficient, strategic procurement. Leveraging phased scheduling allows clients to ride out short-term market spikes and unlock trade synergies. To avoid nasty surprises, consider integrating escalation clauses into contracts, index-linking project budgets to materials benchmarks, and maintaining resilient contingency reserves. These proactive measures transform cost uncertainty from a threat into a managed challenge-keeping projects on track as cost pressures converge in the years ahead.

Q&A

Q: What does “12% increases by 2030” actually mean?

A: It refers to a cumulative rise in building costs between now and 2030, not a single-year jump. Think of it as a steady tide: roughly 1.8-2.0% average escalation per year compounding to about 12% by 2030, under a moderate scenario. Actual outcomes will vary by location, sector, and project complexity.

Q: Why are building costs expected to rise at all?

A: Several slow-moving forces are pushing upward:

– Labor: Aging trades workforce, training bottlenecks, and steady wage growth.

– Materials: Energy-intensive inputs (cement, steel, glass) remain exposed to fuel and carbon costs.

– Regulation: Higher energy performance, embodied-carbon reporting, and safety standards add scope.

– Supply chains: Concentration in certain components (e.g., switchgear) and geopolitical frictions.

– Finance and insurance: Higher cost of capital and climate-related premiums.

– Productivity gap: Construction productivity lags other industries, so wage rises don’t fully translate into output gains.

Q: Isn’t inflation coming down?

A: General inflation has cooled in many regions, but construction has its own drivers. Even when headline inflation slows, sector-specific issues-labor scarcity, code changes, and long-lead components-can keep construction escalation above or decoupled from CPI.

Q: Could costs also go down?

A: Yes, certain categories can dip-lumber did in 2022-2023, for example. But broad, sustained cost deflation across a full project basket is uncommon. Planning for a range (for example, 8-18% cumulative by 2030) is more resilient than betting on a single line.

Q: What are the “hidden” cost drivers people overlook?

A:

– Grid connection delays and transformer availability.

– Permitting timelines that extend prelim/design overhead.

– Insurance requirements for extreme-weather resilience.

– Cyber and MEP complexity for smart buildings and data-heavy uses.

– Local-content rules that limit supplier options.

Q: Which components are most likely to face long lead times?

A: Electrical switchgear and transformers, specialized HVAC (heat pumps, DOAS units), curtain wall systems, lab/cleanroom kit, and elevator packages can stretch procurement schedules. Early visibility and pre-purchase strategies can prevent schedule-driven cost spikes.

Q: If the rise is gradual, why plan now?

A: Because decisions you make early determine 70-80% of lifecycle cost. Early scoping, locking key packages, and shaping design to readily available materials can avoid paying premiums later. In procurement terms, time is pricing power.

Q: What practical steps can clients take in the next 90 days?

A:

– Baseline: Build a parametric cost model with escalation scenarios (low/base/high).

– Prioritize: Separate must-haves from nice-to-haves; tie each to cost and carbon.

– Market test: Soft-sound key trades for capacity and lead times.

– Long-lead scan: Identify and, where sensible, prequalify or pre-order critical components.

– Contracting approach: Decide on early contractor involvement (ECI) or framework agreements for speed and certainty.

Q: How do escalation clauses work-and should we use them?

A: Escalation clauses adjust contract prices based on defined indices (e.g., steel, fuel) over time. They:

– Share risk transparently.

– Reduce “risk padding” in bids.

– Require clear triggers, caps/floors, and index selection.

They’re most useful on longer programs or volatile packages.

Q: What’s the difference between contingency and escalation?

A: Contingency covers unknown scope/design risk (things you didn’t foresee). Escalation covers known time-related price movement (what happens while you wait). You typically carry both: design/construct contingency and a separate, dated escalation allowance.

Q: Can sustainability targets raise costs-and can they also save money?

A: Both can be true. Higher-performance envelopes and low-carbon materials can lift upfront costs modestly, but:

– Operational savings (energy, maintenance) often offset capex over the asset life.

– Compliance risk drops (fewer retrofits later).

– Incentives and tax credits can narrow the gap.

Whole-life cost analysis makes the trade-offs explicit.

Q: What delivery models help control costs through 2030?

A:

– Early Contractor Involvement (ECI) to optimize means and methods.

– Design-build or integrated project delivery (IPD) to align design with procurement and schedule.

– Frameworks/alliance contracts for multi-project pipelines, securing capacity and standardizing details.

Choose based on governance constraints and market maturity.

Q: How can design reduce exposure to future increases?

A:

– Standardize grids, modules, and details to unlock prefabrication.

– Design to common, multi-sourced materials and profiles.

– Rationalize MEP systems; avoid bespoke components where possible.

– Allow alternates: pre-approved equivalents keep competitive tension.

– Optimize for logistics: fewer lifts and simpler sequencing save crane and labor cost.

Q: Does modular or off-site construction really help with costs?

A: It can. Benefits include schedule compression, reduced waste, better quality, and less site labor exposure-all of which curb escalation risk. Savings depend on scale, repeatability, transport constraints, and early commitment to modular-friendly design.

Q: What about financing-do rates change the calculus?

A: Yes. Higher interest rates increase carrying costs and sharpen the value of finishing sooner. Securing price and schedule can be as impactful as trimming unit rates. Sensitivity-test your pro forma across rate paths and delivery durations.

Q: How do we brief the board without alarmism?

A:

– Present a base case with two bookends (optimistic/pessimistic).

– Separate controllable levers (scope, sequencing, contracting) from market forces.

– Highlight schedule as a cost tool, not just a date.

– Show decision gates: what gets locked now, what can wait, and the cost of waiting.

Q: What if we’re not ready to build until 2028?

A: You can still reduce risk now:

– Secure entitlements that won’t expire.

– Standardize a kit-of-parts across your pipeline.

– Establish framework agreements for key trades.

– Prequalify suppliers; map alternates.

– Reserve or option long-lead capacity where feasible.

Q: How do we keep bids competitive in a tight market?

A:

– Be a “client of choice”: clean documents, quick decisions, fair risk allocation.

– Package work to fit different contractor sizes.

– Offer prompt payment and reasonable LDs.

– Publish alternates and accept equals to widen the field.

Q: What’s a simple checklist to avoid paying the 12% premium?

A:

– Define: Clear brief, performance targets, and value hierarchy.

– Model: Escalation scenarios and whole-life costs.

– Engage: Early contractor and supplier input.

– Standardize: Modular grids, repeatable details, alternate approvals.

– Procure: Lock long-lead items, use escalation clauses wisely.

– Stage: Phase scope to de-risk critical paths.

– Monitor: Quarterly market checks and design-to-budget control.

Q: Bottom line-what’s the smartest move right now?

A: Turn time into an asset. Use the current planning window to lock scope, standardize design, secure capacity, and set fair risk-sharing mechanisms. That won’t stop the tide, but it can keep the water below your threshold-and often below that headline 12%.

Insights and Conclusions

As the industry edges toward a projected 12% cost rise by 2030, the most effective response isn’t urgency-it’s clarity. Define scope early. Refresh budgets against credible escalation assumptions. Test multiple procurement paths. Lock long-lead items when it makes sense, and keep options open with flexible specifications and phasing. Treat time as a cost driver, not a calendar detail.

The projects that hold their shape through inflation are the ones built on decisions made before prices move, not after. Start with data, plan for variance, and revisit the plan often. You may not outrun escalation, but you can out-organize it-so price isn’t the last thing you design.