The cost of putting a spade in the ground in 2025 is no longer a temporary spike but a new operating reality. UK builders face a knot of pressures-stubborn labour shortages, volatile shipping routes, pricier energy and insurance, tighter regulation, and still-elevated borrowing costs-each tugging on margins from a different angle. Yet the response across the industry is less about waiting for relief and more about redesigning how projects are conceived, procured, and delivered.

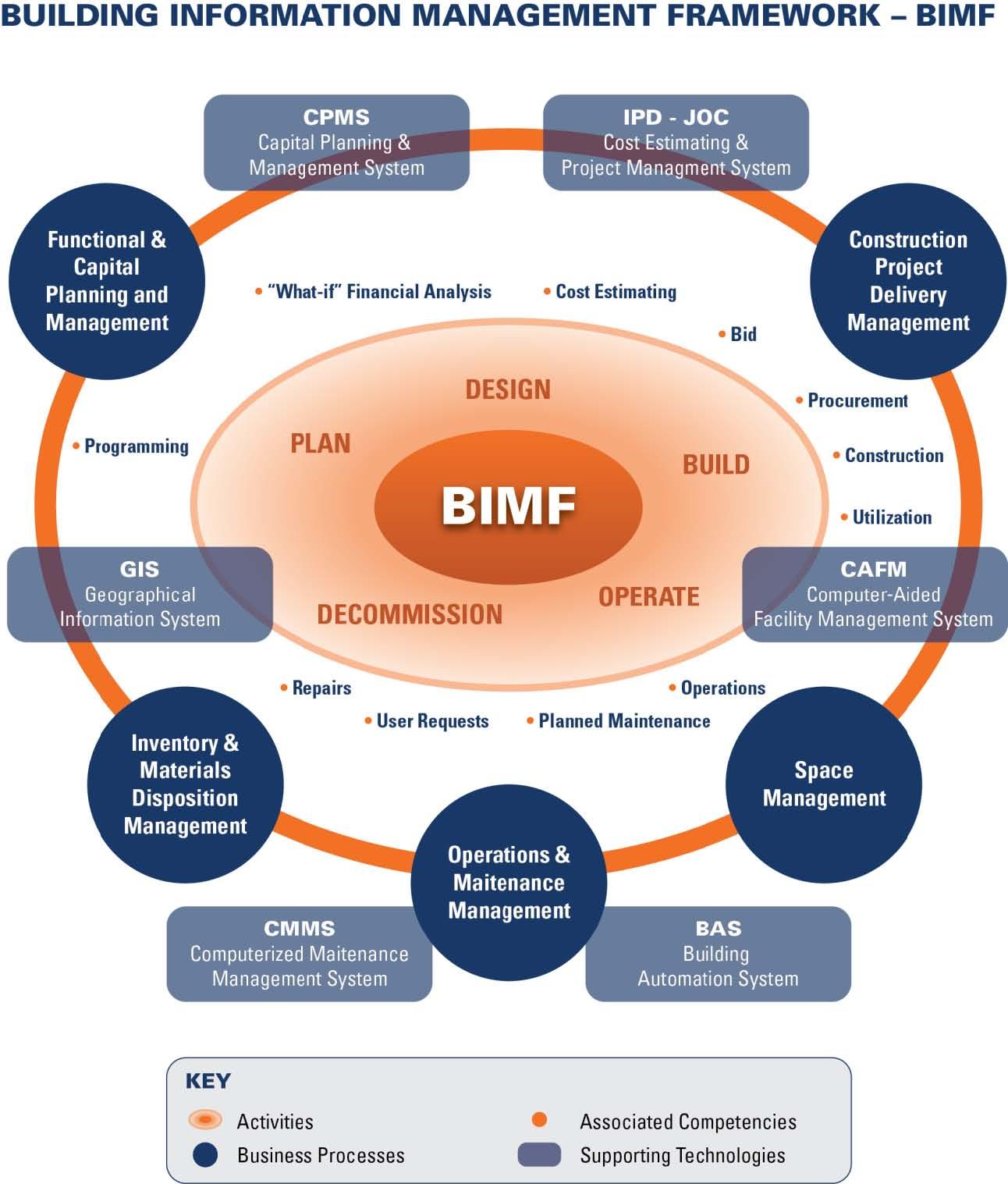

From Tier 1 contractors to regional SMEs, firms are chasing earlier cost certainty and steadier throughput: two‑stage tenders and target‑cost models, long‑term supplier frameworks, forward buying of key materials, and more disciplined risk selection. On site and in design studios, cost is being managed with a sharper pencil-standardised details, value engineering that preserves performance, increased use of MMC and offsite fabrication, and digital cost dashboards linked to BIM. Leaner sites, tighter waste control, electrified plant, and circular procurement are cutting both bills and carbon, while alternative materials and recycled content help ease exposure to volatile commodities. These rigorous planning tactics are now essential, whether you’re managing a commercial site or looking for expert house renovation contractors to complete a single project.

Labour strategy is shifting too, with multi‑skilling, apprenticeships, and productivity tooling offsetting wage inflation. Many are rebalancing pipelines toward refurbishment, retrofit, and compliance work ahead of the Future Homes Standard and wider decarbonisation targets.

This article explores the tactics that are sticking-the contractual structures, procurement plays, technical choices, and site practices that are helping UK builders keep projects viable in 2025-and what they mean for clients, supply chains, and communities.

Table of Contents

- Lock in value through lean procurement local suppliers and index linked contracts

- Protect margins with offsite construction modular design and standardised details

- Cut site energy costs using electrified plant smart scheduling and on site renewables

- Use data driven forecasting and risk sharing clauses to keep projects cash positive

- The Way Forward

Lock in value through lean procurement local suppliers and index linked contracts

Streamlined buying is turning cost spikes into predictable outlays: standardised kits of parts, early-spec’d alternates, and aggregated orders across sites cut waste and secure keener terms. Partnering with nearby vendors shortens lead times, trims fuel surcharges, and unlocks faster substitutions when markets pivot. With rolling forecasts and call-offs, local SMEs plan capacity confidently, lowering unit costs without squeezing quality. Layer in digital POs, consolidated drops, and transparent rebates to make the buy-side boring-in the best, most bankable way.

- Simplify SKUs and pre-approve equivalent products

- Bundle repeat items across projects to win framework pricing

- Reserve stock via vendor-managed inventory at local merchants

- Two-stage tendering to surface value-engineering early

- Consolidated logistics (milk-runs, timed windows) to cut handling

- Clear, prompt payments so SMEs can sharpen pencils

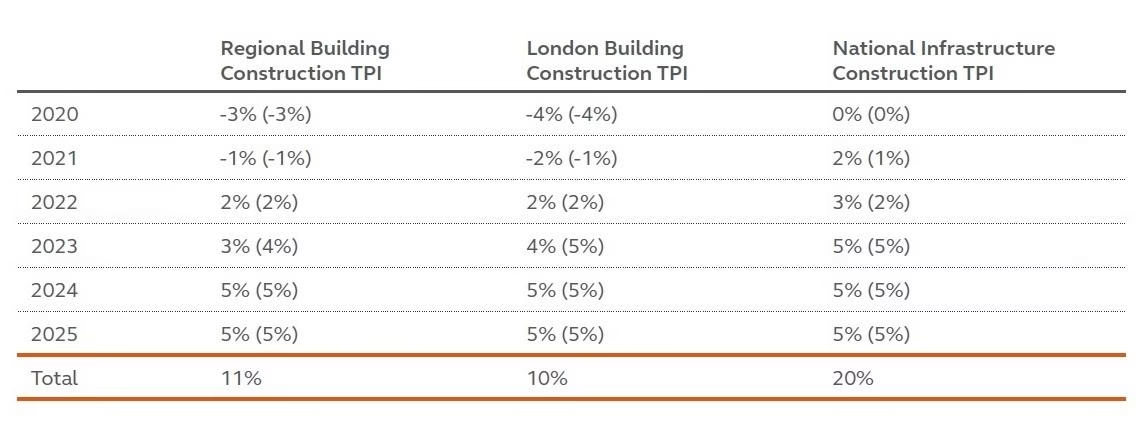

Where prices keep moving, indexation balances risk and keeps programmes fundable without constant haggling. Set a neutral baseline date, define the index (or basket), and agree a tolerance band (e.g., contractors absorb ±3%) with caps/floors beyond that. Reconcile quarterly, separate labour from materials where sensible, fix margins over indexed costs for long-lead packages, and require published data or audited baskets to verify shifts. Clear audit rights, sunset dates, and change-control keep the mechanism tight-and disputes rare.

| Index | Best use | Review | Note |

|---|---|---|---|

| BCIS Materials Cost Index | Core materials packages | Quarterly | Construction-focused; mirrors supplier inputs |

| ONS Construction OPI | Whole-project adjustments | Quarterly | Broad signal; avoid over-correcting single trades |

| ONS CPIH | Overheads & prelims | Monthly | Stable headline measure; not material-specific |

| Pre-agreed supplier basket | Specialist systems | Monthly/Quarterly | Named SKUs; audited invoices apply |

Protect margins with offsite construction modular design and standardised details

Factory-first delivery is letting UK contractors lock in predictable costs by replacing one-off detailing with a repeatable, kit-of-parts approach. Design libraries built around common spans, service zones, and grid dimensions cut coordination time and unlock parallel manufacturing of panels, pods, and MEP assemblies. With DFMA baked in at Stage 3, suppliers can price earlier, materials are hedged, and prelims shrink as site time compresses. The payoff is lower rework, fewer snags, and steadier cashflow as modules land just-in-time onto a clean, takt-planned programme.

- Standardise interfaces: consistent floor-to-floor heights, 3.6 m grids, 150 mm service zones.

- Deploy sub-assemblies: bathroom pods, MEP risers/skids, prewired distribution boards.

- Freeze earlier: lock critical details at 60-70% using BIM object libraries and QA checklists.

- Contract smart: align integrator agreements with manufacturers for parallel offsite production.

- Plan flow: takt scheduling and JIT deliveries to minimise inventory and crane time.

| Package | Modular option | Est. cost | Programme | Quality |

|---|---|---|---|---|

| Bathrooms | Pods | -5-12% | -20-30% | Snags ↓60% |

| MEP | Riser cassettes | -4-8% | -15-25% | Leak risk ↓ |

| Façade | Panelised | -3-7% | -25-35% | Air-tight ↑ |

| Roof | Pre-fab cassettes | -2-6% | -15-20% | Weather risk ↓ |

| Stairs | Precast | -2-5% | -10-15% | Tolerance ↑ |

Margin protection also relies on governance: NHBC Accepts (or equivalent) approvals for assemblies, design-change control to prevent late bespoke tweaks, and clear tolerances at every interface. By cataloguing “permit-to-use” details, teams reduce design hours, stabilise supplier capacity, and maintain warranties across sites and typologies. Paired with 4D sequencing and digital QA, the result is fewer site unknowns, safer workfaces, and outcomes that survive price swings-delivering the same building, every time, with less waste and more certainty.

Cut site energy costs using electrified plant smart scheduling and on site renewables

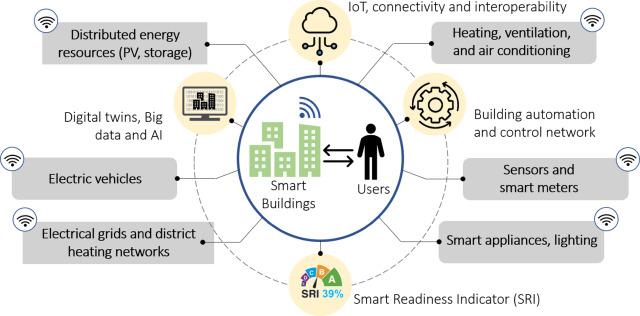

On UK sites, electricity and fuel line items are biting harder in 2025, but pairing electric plant with smart timetables and modular renewables turns that pressure into savings. Think of the compound as a mini-microgrid: solar mats on welfare roofs, a plug‑and‑play battery to shave peaks, and chargers that queue equipment when tariffs are cheapest. Telematics from excavators, telehandlers and hoists can drive an automated plan that avoids DUoS red bands, staggers charging, and powers welfare blocks from stored midday solar. The result is fewer hired generators idling, lower standing charges per kWh delivered, and steadier power for critical tasks.

- Shift high‑draw tasks (hoists, pumps, tower cranes) out of late‑afternoon peaks and into low‑tariff windows.

- Charge and top‑up at solar noon so batteries and plant absorb site PV first, grid second.

- Use a battery as a buffer to cap connection demand, downsizing temp supply and generator hire.

- Priority charging rules: cranes and MEWPs first, support plant later; pause non‑critical loads when tariffs spike.

- Idle and geofence policies that auto‑sleep equipment and cut phantom loads in cabins and compounds.

| Action | Typical saving | Quick tip |

|---|---|---|

| Off‑peak scheduling | 10-25% | Align with supplier time‑of‑use rates |

| Solar + battery | 15-35% | Right‑size: 1-2 days of welfare load |

| Smart charging | 5-12% | Set max site kW and queue plant |

| Generator hybrid | 20-40% fuel | Run genny only for charge/peaks |

Implementation is pragmatic: pull a week of plant telematics and smart‑meter half‑hourly data, plot genuine peak windows, then publish a site power timetable that trades a little convenience for big savings. Coordinate with your DNO and supplier on time‑of‑use tariffs, cap demand with a battery energy storage system, and automate set‑points through your charger fleet. Procurement can rent solar‑hybrid gensets and PV skids for short programmes, while QS teams track kWh per £1k build, peak kW reduced, and diesel hours avoided as KPIs. With these levers set, crews keep productivity, the grid tie stays stable, and the cost curve bends down without drama.

Use data driven forecasting and risk sharing clauses to keep projects cash positive

Builders are leaning on data-led forecasting to spot pressure points before they hit cashflow. Rolling 12-week lookaheads blend supplier quotes, commodity feeds, and site productivity to create probability bands for cost and revenue, while dashboards flag when cash buffers are at risk. With early signals, teams re-sequence activities, pull forward procurement on volatile packages, and tighten milestone billing-keeping working capital healthy without slowing delivery.

- Materials indices: steel, timber, and concrete trends

- Supplier lead-times: variance vs. baseline and surge fees

- Labour rates: trade-specific wage drift and availability

- FX exposure: imported MEP/finishes sensitivity

- Site productivity: weather, rework, and access constraints

On the commercial side, shared-risk contract terms convert volatility into managed decision points rather than disputes. Simple, pre-agreed triggers-index moves, delivery slippage, or scope price caps-activate automatic adjustments, spreading exposure and protecting cash neutrality. Pairing these with open-book reporting and quick review cycles maintains trust, preserves margins, and reduces claim-heavy admin that starves projects of liquidity.

| Clause | Trigger | Cash impact |

|---|---|---|

| Index-linked adjustment | Materials index ±5% in a quarter | Auto price reset on affected items |

| Pain/Gain share | Actual vs. target cost variance | Balanced incentives; margin stability |

| Rise-and-fall (named trades) | Supplier quote delta beyond cap | Partial uplift; cash-neutral variance |

| Milestone re-indexing | Milestone slips >14 days | Interim uplift preserves cashflow |

The Way Forward

In the end, rising costs haven’t rewritten the rulebook for UK construction-they’ve raised the stakes. The response is less about silver bullets and more about steady calibration: pairing modern methods where they fit, sharpening digital cost controls, leaning into long-term supplier relationships, and designing to budget from day one. Not every tool suits every site, and margins still feel the draught, but the playbook is broader and the decisions more deliberate.

What happens next will hinge on more than procurement and pricing. Skills pipelines, planning reform, energy volatility, and the pace of regulatory change will all shape how far these tactics travel. For now, resilience is looking practical rather than grand-smarter sequencing, cleaner data, clearer contracts, and honest conversations up and down the chain.

If last year was about firefighting, 2025 is about fireproofing. Progress may be incremental, but across schedules and balance sheets it compounds. Rising costs may not vanish, yet the industry is learning-brick by careful brick-to build around them.