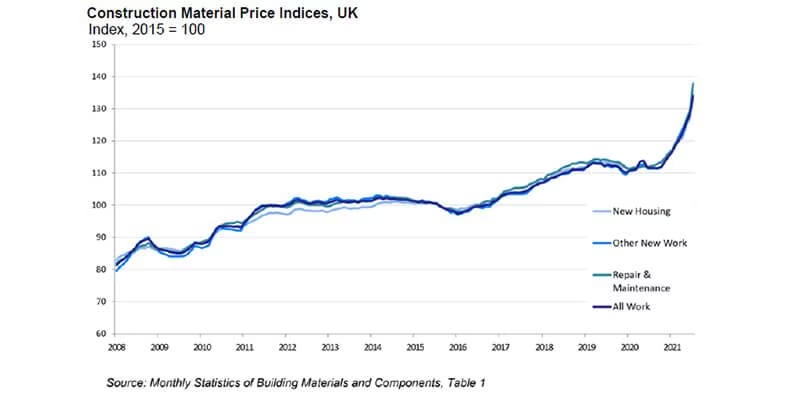

In UK construction, material prices have become a moving target. Timber, steel, cement and plasterboard can shift between tender and start date, and quotes often expire before decisions are made. Energy costs, exchange rates, global demand and logistics have all played a part, leaving both Building contractors in UK and clients trying to plan with numbers that won’t sit still.

This article is about regaining control without cutting corners. It turns cost volatility into a practical budgeting playbook: how to build sensible contingencies, time your procurement, lock in key prices, and specify workable alternatives without compromising compliance or quality. We’ll touch on UK‑specific tools and levers-using price indices to benchmark, choosing contracts with fluctuation options, structuring allowances clearly, and collaborating with merchants and suppliers to reduce exposure.

You’ll find guidance tailored to both sides. For builders: tender strategy, early ordering, substitution protocols, waste reduction, and cash‑flow planning. For clients: scope clarity, faster decisions, transparent allowances, and change control that protects programme and price. The goal is simple: fewer surprises, better conversations, and projects that stay on track even when the market doesn’t.

Think of what follows as both forecast and map. We can’t calm the prices, but with smarter budgeting and clearer agreements, we can navigate them.

- ONS Data: Track month-by-month percentage changes for key materials.

- Merchant Alerts: Set up notifications for updated stock and lead time bulletins.

- Project Timing: Align big buys for “off peak” months where possible.

| Material | ONS Price Index (May 2024) | Avg. Lead Time | Peak Season |

|---|---|---|---|

| Timber | +8.4% | 6 weeks | May – August |

| Concrete | +3.1% | 3 weeks | April – June |

| Insulation | +6.7% | 5 weeks | Sep – Dec |

The secret weapon for smarter budgeting is integrating these insights into your purchasing and cost strategies. Use real-time data to inform when to lock in prices, structure call-off contracts, or negotiate early commitments for volatile products. Value engineering isn’t just about swapping out materials-think standardised sizes to reduce custom-cut waste, or modular approaches that enable efficient takeoff and trim down offcuts. Collaborate openly with suppliers via multi-quote benchmarking and consider framework agreements for consistency. When sharing risk, keep cost plans transparent, use fluctuation clauses to balance surprises, select provisional sums with care, and manage client contingencies with staged releases.

- Framework Deals: Lock in rates before peak periods hit.

- Bulk & Call-Off: Order in larger batches with scheduled delivery to suit programme shifts.

- Fair Risk: Mechanisms like fluctuation clauses protect both sides from wild price swings.

Q&A

Q: Why are UK construction material prices so jumpy?

A: Several forces hit at once:

– Energy costs feeding into cement, steel, glass and kiln-fired products

– Exchange-rate swings on imports, freight and fuel surcharges

– Global supply shocks and lead-time bottlenecks

– Regulatory changes and product re-certification (UKCA/CE)

– Strong demand in certain sectors outpacing local capacity

– Weather and geopolitical risks affecting timber and metals

Q: How do I set a realistic budget in a volatile market?

A: Treat the budget as a living document:

– Build a cost baseline plus an explicit escalation allowance tied to an index

– Add contingency (typically 10-15% for straightforward work; more for complex/refurb or import-heavy packages)

– Time-phase your spend so you can see exposure by quarter

– Keep a risk register with priced risks and trigger points for action

Q: Which price indices should I track?

A: Use a blend:

– BCIS General Building Cost Index and BCIS Materials Cost Index (project-level planning)

– ONS Producer Price Inflation for construction materials and components (category detail)

– Trade bodies’ trackers (e.g., Build UK materials reports)

– Your own merchant quotes log for real-world movement by SKU

Q: Fixed price or adjustable? Which contracts help manage inflation?

A: Match the mechanism to risk appetite:

– JCT: consider adding Fluctuations (with a clear schedule of indices) or bespoke material price adjustment clauses

– NEC: Secondary Option X1 (Price Adjustment for Inflation) with defined indices and base date

– For short programmes, a fixed price with short validity can be fine; for longer, use adjustment clauses or break options

– Make provisional sums and PC sums specific, with change-control rules to avoid disputes

Q: What procurement tactics actually lower material costs?

A: Combine competition with commitment:

– Get three comparable quotes per key package and standardise specs

– Negotiate framework or call-off agreements with price locks on core lines

– Use volume where it counts (fixings, plasterboard, insulation) and avoid speculative bulk on volatile items

– Ask for rebates, free carriage thresholds, and extended quote validity

– Consider group buying schemes or merchant account tiers

Q: Is bulk buying always smart?

A: Only if risks are managed:

– Check storage capacity, security, moisture control and insurance

– Use vesting certificates and off-site materials clauses so title passes when you pay

– Confirm warranties don’t start until installation

– Prefer call-off orders over one big drop to reduce theft/damage and design-change risk

Q: How can builders protect margin day to day?

A: Focus on waste, accuracy and timing:

– Tight take-offs; standardise details to cut offcuts

– Agree returns policies for unopened packs

– Prequalify alternates so substitutions are quick and compliant

– Forward-buy long-lead, high-volatility items with call-offs

– Track delivery charges and fuel surcharges; consolidate drops

– Use digital stock and price tracking to avoid last-minute premiums

Q: How can clients get value without eroding quality?

A: Design to a price, not price to a design:

– Freeze performance requirements early and invite equivalent products, not sole brands

– Run value-engineering workshops before tender, not after award

– Use two-stage/open-book where market is hot; secure key materials early

– Approve changes fast; delay costs more than discounts save

– Evaluate whole-life cost (maintenance, energy) alongside capital

Q: What’s a sensible contingency and escalation allowance?

A: Typical starting points:

– Contingency: 10-15% for simple new build; 15-25% for refurb/complex services

– Escalation: reference BCIS or ONS indices from tender base date to mid-point of construction

– Review quarterly; if exposure shrinks through early procurement, release funds

Q: How do I plan for lead times without freezing design too early?

A: Use a long-lead register:

– Identify critical items (insulation, MEP kit, cladding, lifts) with decision dates

– Place advance orders with design-freeze milestones and substitution pathways

– Hold coordination workshops so early orders don’t clash with later design

– Keep alternates pre-approved as a safety valve

Q: How do VAT and cash flow interact with rising prices?

A: Watch the mechanics:

– Domestic Reverse Charge shifts VAT accounting for many CIS services between VAT-registered businesses; it affects cash flow

– Residential new-build is often zero-rated; refurb may attract 5% or 20% depending on scope-check eligibility

– Negotiate payment terms aligned to procurement; avoid funding large deposits without security

– Use applications for payment that mirror material call-offs to reduce exposure

Q: What clauses help if prices spike mid-project?

A: Build in relief valves:

– Defined material-price adjustment clauses linked to indices and base dates

– NEC early warning/compensation events; JCT fluctuation options or bespoke change triggers

– Break clauses or re-price gates at stage boundaries

– Clear change-control and evidence requirements (quotes, delivery notes)

Q: How do we approve substitutions safely?

A: Follow a compliance-first checklist:

– Match performance: fire, structure, acoustic, thermal, durability, warranty

– Check certification (UKCA/CE where applicable, BBA/Agrément, DoP)

– Confirm compatibility with adjacent systems and manufacturer warranties

– Record decisions for the golden thread; update drawings and O&M manuals

Q: Will choosing low-carbon options help my budget?

A: Sometimes yes, sometimes later:

– Timber structures can reduce steel/concrete volumes and programme time

– Reclaimed or recycled content products can be competitive if sourced early

– Operational savings (e.g., better insulation) offset capital; assess whole-life cost

– Availability and certification are key-secure supply early

Q: What are quick wins for small projects and homeowners?

A: Keep it simple and decisive:

– Make a priority list: where to spend and where to be flexible

– Use PC sums for finishes but lock core materials early

– Buy appliances/sanitaryware early if models are fixed

– Agree substitution rules up front; approve promptly to avoid re-pricing

– Schedule works to reduce wasted deliveries and idle time

Q: How can we reduce waste that inflates material bills?

A: Design and site discipline:

– Order to cut lengths and modular sizes

– Standardise openings and set-outs

– Protect materials on site; plan dry, secure storage

– Reuse offcuts where compliant; segregate and return surplus

Q: What are common pitfalls to avoid?

A: Watch for these:

– Letting quote validity lapse before award

– Over-reliance on provisional sums with vague scopes

– Bulk buying without storage/insurance or design certainty

– Single-brand specifying that blocks competitive pricing

– Slow approvals that force last-minute, high-cost substitutions

Q: Any tools we can use to stay ahead?

A: Mix data with habits:

– Price books (e.g., Spon’s), BCIS forecasts, ONS series, merchant apps

– A simple dashboard tracking top 20 materials by value and lead time

– Quarterly cost reviews and scenario planning (best/base/worst)

– Supplier scorecards for price, reliability and service

Q: What’s the one habit that beats rising prices?

A: Turn your budget from a snapshot into a sat-nav: update it regularly, link it to decisions and dates, and let the data steer when to lock, switch or wait.

Note: This is general guidance for the UK market. Always check your specific contract, project scope and tax position, and seek professional advice where appropriate.

To Wrap It Up

Rising material costs aren’t a storm to outrun; they’re a climate to build within. The projects that stay on track do so by treating the budget as a living document, planning procurement with intent, and keeping specification choices flexible without compromising quality. When builders and clients share clear information, set realistic allowances, agree sensible contingencies, and use transparent contracts with fair escalation mechanisms, volatility stops dictating outcomes.

Keep your cost data current, watch the indices, test the market early, and be ready with plan B materials that still meet the brief. Small, consistent habits-regular cost reviews, early orders for critical items, open conversations about scope-compound into resilience.

In the end, beating rising prices isn’t about cutting corners; it’s about sharpening them. Build with clarity, decide with evidence, and budget as if it’s part of the design. The numbers may move, but your project can still land exactly where it needs to-on time, on spec, and under control.